A Comprehensive Guide: What Do Credit Card Scanners Look Like?

Introduction

In a world where cash is swiftly being replaced by plastic, credit card scanners have become an essential tool in every financial transaction. This comprehensive guide aims to unmask what credit card scanners look like, their physical characteristics, the major types available in the market, and how to identify the secure and reliable ones.

What Exactly Are Credit Card Scanners?

Credit card scanners, alternatively termed credit card readers, are much more than meets the eye. They embody the centre of digitized trade, ensuring every transaction is smooth sailing. At their core, they are:

- Electronic Devices: These machines utilize technology to read and process information. This stored data is usually found on a credit card’s magnetic stripe or embedded in a smart chip.

- Transaction Validators: Scanners interface directly with either computers or point-of-sale systems. Their primary job is to validate and approve transactions, a critical role in our modern, commerce-driven world.

- Wide Range of Application: Their use isn't confined to any specific place. These machines carry out their roles impeccably in a myriad of settings. Retail stores, restaurants, banking institutions, and even online marketplaces rely on credit card scanners.

In a nutshell, credit card scanners have reshaped the way we do business and trade. Thus, having a good understanding of these devices is beneficial for consumers and business owners alike. Guaranteeing familiarity with several types of scanners, identifying their characteristics, and ensuring their security measures will only enhance your confidence in using them.

What Are the Physical Characteristics of Credit Card Scanners?

Examining the physical criteria of credit card scanners is beneficial for anyone interacting with this ever-important tool, whether they're consumers or business owners. These devices vary based on their design, size, and features, yet, some universal characteristics can guide you in recognizing them. Here are some notable aspects typical of most credit card scanners:

• Size and Portability: Credit card scanners aren't usually bulky. They are designed to be compact and lightweight to ensure practicality and ease while conducting transactions.

• Presence of a Card Slot: The most prominent feature of a credit card scanner is a card slot. It's either a magnetic strip channel for swiping or a chip-insert slot, or sometimes both.

• Interface and Display: Many scanners come with buttons or a touchscreen display. These features allow interaction, such as PIN input during transactions or on-screen prompts.

• Modern Features: Advanced models can come with additional features like contactless payment compatibility, barcode scanners, or receipt printing functionalities, distinguishing them from simpler models.

The design of these scanners strikes a balance between user accessibility and comprehensiveness. However, as technology advances, the physical characteristics of these devices continue to evolve. It’s crucial to stay up-to-date with the latest tech breakthroughs shaping the industry to gain an accurate understanding of these dynamic tools.

Which Major Types of Credit Card Scanners Exist in the Market?

As we navigate through the cashless economy, credit card scanners have gained immense popularity. Understanding their types can dramatically enhance efficiency, security, and overall user experience. There are three primary credit card scanners currently reigning in the marketplace. Let's explore each:

1. Magnetic Stripe Reader (MSR):

- Description: These are conventional scanners that read data from the magnetic strip present at the back of the card.

- Usage: Frequently used due to their compatibility with most credit and debit cards.

- Key Fact: However, they are gradually being phased out due to low security when compared to other types.

2. Chip Card Reader (EMV):

- Description: EMV readers utilize smart chip technology, reading data from the embedded microprocessor chip on the card.

- Usage: Most cards are now equipped with chips for enhanced security hence these readers are commonplace.

- Key Fact: EMV technology has lowered card-present fraud by up to 76% since its introduction.

3. Contactless Readers (NFC):

- Description: NFC readers employ Radio-frequency Identification (RFID) or Near Field Communication (NFC) technology for contactless payments.

- Usage: NFC readers are trending due to the rise in smartphone payments and contactless cards.

- Key Fact: Analysts predict that contactless transactions will account for 35% of all card payments made in the U.S by 2022.

Each type of credit card scanner showcases unique features; hence, businesses must consider their specific requirements while choosing the most suitable readers for them.

How Do Different Types of Credit Card Scanners Look?

Credit card scanners present distinct physical characteristics based on their functionalities. Here's a detailed look at the three main types:

1. Magnetic Stripe Readers (MSR):

- Shape and Size: They usually resemble a small rectangular box.

- Key Feature: A prominent, long channel is its defining attribute, where the card needs to be swiped through for data reading.

- Functionality: They read the data stored on the magnetic stripe on the back of a credit card.

2. EMV Chip Card Readers:

- Shape and Size: Comparable in size to MSR, but the design includes additional features, making it slightly bulkier.

- Key Feature: Incorporated with an insertion slot instead of a swipe channel, specially designed to read chip-embedded cards.

- Functionality: They are designed to process transactions through the card's chip rather than the magnetic strip.

- Additional Hardware: Most models possess a keypad for pin input, affirming transaction security.

3. NFC Readers (Contactless):

- Shape and Size: They might vary in shape and size based on the incorporation of NFC technology along with other card reading capabilities.

- Key Feature: Present with a clear NFC symbol to indicate the spot for card or mobile tap.

- Functionality: Offers the convenience of contactless payments using RFID or NFC technology.

In recent times, markets are storming with models integrating all three functionalities for all-rounded usability. Although they end up being slightly larger, they offer the convenience of variety, being able to process a broader range of payment methods. You can identify multi-function models by the various slots, icons, and sometimes a presence of a small screen for transaction details display.

Understanding the appearance of each credit card scanner type can enhance your operational ease while ensuring a smooth and fast transaction. Regardless of the type, secure and dependable scanners follow PCI compliance standards strictly, employing encryption and secure PIN-input systems.

How Can One Identify Secure and Reliable Credit Card Scanners?

Determining the security and reliability of credit card scanners is now more essential than ever due to the surge in fraudulent activities and cybercrimes. Here's a checklist to help you identify secure and trustworthy credit card scanners:

1. Payment Card Industry (PCI) Compliance: Above all else, ensure your credit card scanner aligns with the Payment Card Industry Security Standards. This standard requires the card reader to comply with strict security regulations, thus ensuring the safe handling of sensitive credit card information.

2. Secure PIN Entry System: Reliable scanners will usually feature a secure PIN entry system. This often involves end-to-end encryption, ensuring protection of your data during transmission.

3. Encryption Technology: Look for scanners that use encryption technology like 3DES, an advanced symmetric-key encryption standard, which provides an additional layer of security.

4. Renowned Brand or Provider: A credit card scanner from a well-known, respected brand or provider often guarantees better reliability. Research reviews on various brands before committing to any model.

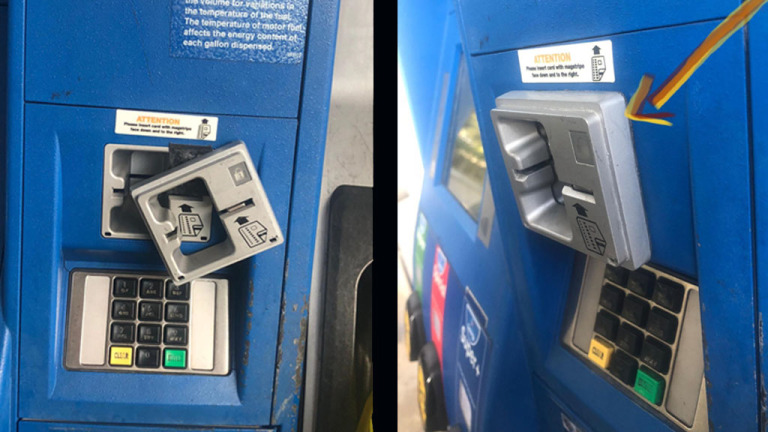

5. Absence of Tampering Signs: It's essential to examine the scanner for any evident signs of tampering, such as loose parts, extra attachments or anything unusual before use.

In 2021, 51% of fraud losses on debit and credit cards were linked to card-not-present transactions, showcasing how crucial it is to ensure your credit card scanner is secure and reliable.

Conclusion

In conclusion, credit card scanners are diverse in appearance and function, with common elements to help identify them. Understanding these differences ensures a complementary and secure transaction experience, driving forward into a cashless economy.

Related FAQs about what do credit card scanners look like

What are the key features to look for in credit card scanners?

When selecting a credit card scanner, consider its technological compatibility (magnetic strip, chip, or contactless), its security features (PCI compliance, secure PIN system, and encryption technology), ease of use, its brand reputation, and of course, the price. It's also crucial to ensure it caters to your business's unique needs.

Are all credit card scanners the same in appearance?

No, credit card scanners vary in appearance based on their functionality. Traditional magnetic strip readers have a swipe channel, chip readers have a card insertion slot, and contactless readers have a clear NFC symbol. Some modern models integrate all these functionalities into one device.

How has technology influenced the look of credit card scanners?

Technology greatly impacts the design of credit card scanners. Advancements have led to the development of compact, multi-functional scanners with added features like contactless payment compatibility, enabling easier, faster and secure transactions. Technological evolution will continue to influence their appearance and functionality.