Demystifying Trading Tools: What Are Stock Scanners?

Introduction

Stock trading has undergone numerous transformations with the advent of modern technology, making it more accessible and efficient. Among the different tools reshaping trading, stock scanners are game-changers. These powerful tools have begun to intrigue a growing number of traders. This blog post aims to demystify stock scanners, unraveling their operations, crucial role in trading, types, selection process, as well as their pros and cons. Reading this article can offer you a comprehensive understanding about stock scanners, and guide you in leveraging them for your trading journey.

What is a Stock Scanner, and How Does it Operate?

A stock scanner, alternatively referred to as a stock screener, is nothing short of a seasoned trader's secret weapon. This prolific tool swiftly sifts through a vast amount of stock data to filter out stocks that meet specific pre-set criteria.

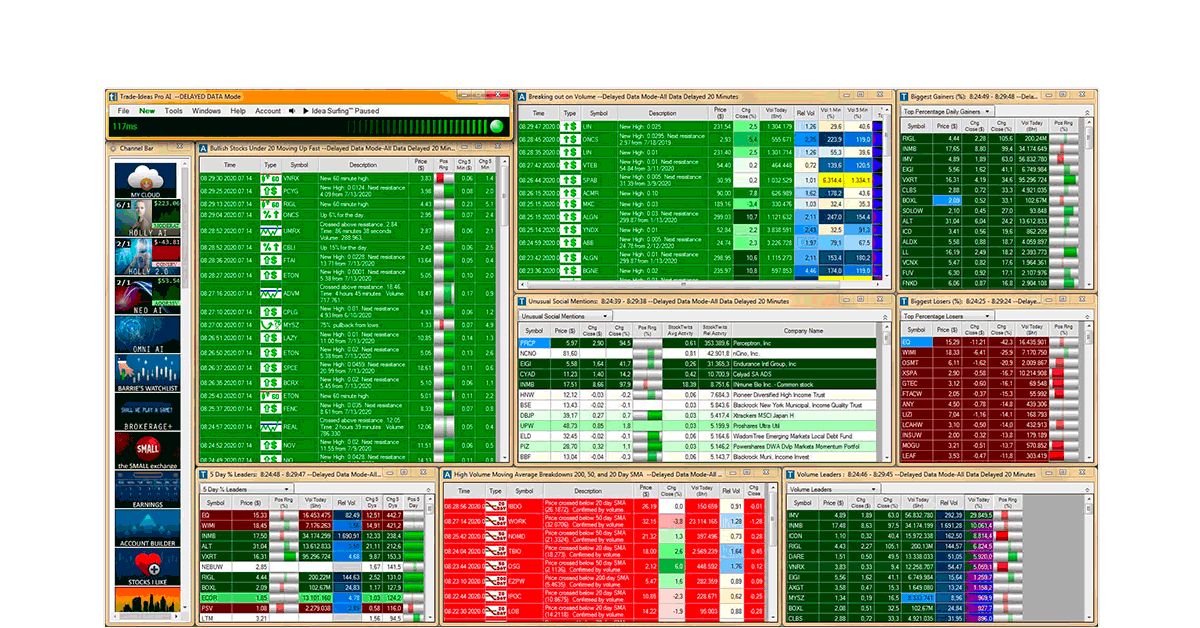

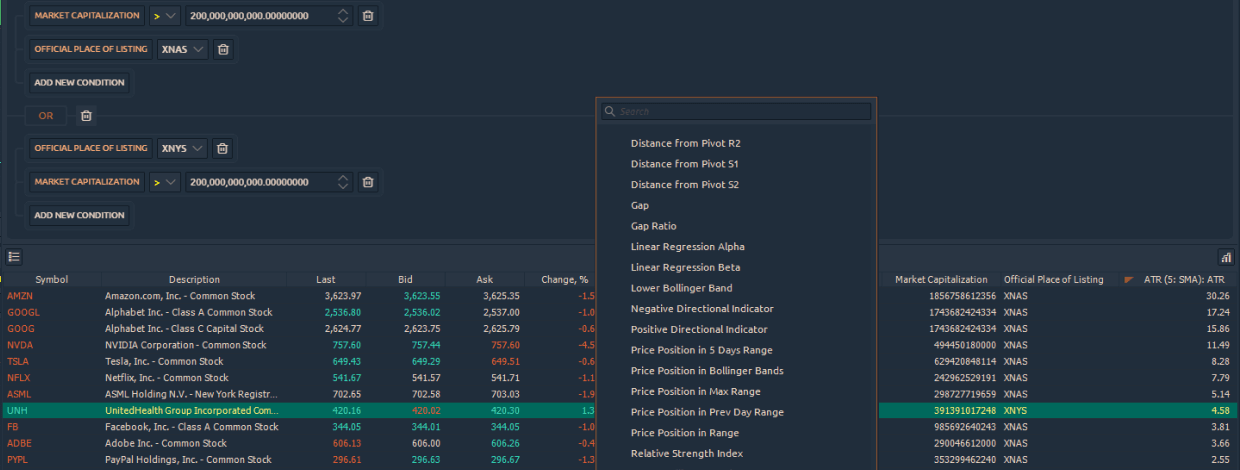

- Functionality: The designated algorithms of the stock scanner scans the entire market promptly, thus enabling it to fetch and provide refreshed information continuously. The tools are tasked to keep an eye out for various criteria such as price fluctuation, change in volume, industry sector, market cap, and more.

- Modus Operandi: The scanner functions utilizing complex algorithms which scrutinize the influx of live data. Traders provide instructions to the scanner by setting specific parameters. The scanner then flags those stocks which adhere to those defined conditions. For instance, if a trader wishes to invest in "technology" stocks that have experienced a rise of 5% or more in the last trading session, the scanner will compile a list of all stocks that comply.

In essence, stock scanners are pivotal in maintaining real-time market vigilance, thereby giving traders a beneficial edge in the game. The ability to respond promptly to market drifts and make crucial buy or sell decisions based on algorithmic screening makes the stock scanner an indispensable tool in the trading arena.

Why are Stock Scanners Essential in the Trading Market?

Trading in the stock market can be a complex undertaking, primarily due to the vast amount of stocks that require vigilant monitoring. Here is where the significance of stock scanners becomes abundantly clear, as they streamline the tracking process and offer an advantageous edge to traders.

Key Reasons Why Stock Scanners are Essential:

- Efficient Filtering: Stock scanners aid in efficiently extracting data from thousands of stocks, saving traders from the grueling task of manual analysis. This efficiency is crucial considering the fast-paced nature of the trading market.

- Identifying Opportunities: Stock scanners are designed to identify trading prospects tailored to a trader's specified strategy. They filter stocks based on pre-set criteria, ensuring traders don't miss out on potential opportunities.

- Real-Time Data: The constantly updating real-time data provided by stock scanners allows traders to make informed decisions swiftly. This is particularly advantageous as it enables traders to respond promptly to market changes.

- Customizability: The versatility of stock scanners lies in their customizability. They can be tailored to fit varied investment approaches, making them a flexible tool in a trader's arsenal.

- Informed Decision-making: By providing insights into market trends and individual stock performance, stock scanners empower traders to make knowledgeable investment decisions. This not only optimizes their trading journey but also lowers risks associated with ill-informed decisions.

Thus, the role of stock scanners in the trading market is undeniable. They form an integral part of modern trading, simplifying complex processes, and facilitating tactical decision-making.

What are the Different Types of Stock Scanners?

Stock scanners come in various forms, catering to different trading needs and styles. Here's a breakdown of the key types of stock scanners, exposing their unique features and uses:

1. Fundamental Stock Scanners: This scanner type fits investors seeking long-term investment opportunities. It is fine-tuned to scrutinize stocks based on comprehensive financial data derived from company balance sheets, cash inflow and outflow, earnings and broad-based economic reports. The resultant data helps forecast the long-term performance and financial health of the companies.

2. Technical Stock Scanners: These scanners are oriented towards traders who rely heavily on short-term trading opportunities. Armed with sophisticated algorithms, these tools analyze and track patterns and trends derived from stock price fluctuations and volume data.

3. Pre-Market Scanners: These are designed to give traders a head start, offering valuable insights into stock activities before the market officially opens. Using this scanner allows traders to be fully prepared for the opening bell by identifying potential opportunities early.

4. Intraday Scanners: Unlike other scanner types, Intraday Scanners monitor trading data in real-time during market hours. Their live tracking capability makes them an ideal tool for day traders seeking the latest data for astute decision-making.

5. Multi-Purpose Scanners: These scanners encompass the features of the scanners mentioned above, from tracking long-term financial data to providing real-time data during market hours. They give users access to a wide range of information, which supports informed trading decisions with their comprehensive overview.

In a nutshell, the right scanner for you mainly depends on your preferred trading style and what specific data is relevant to your strategy. Whether a trader focuses on long-term investment or a fast-paced intraday trading, there's a stock scanner designed to shape their trading experience.

How to Choose the Right Stock Scanner for Your Trading Needs?

The selection of an ideal stock scanner is pivotal in a trader's journey as it simplifies the trading process and steers decisions. Here's a thorough, step-by-step guide to help you choose the right stock scanner that aligns with your trading needs:

1. Identify Your Trading Strategy: Your trading strategy primarily guides you to the appropriate scanner. For example, if you're focusing on long-term investment, a fundamental scanner would be beneficial. It offers detailed financial insights, aiding your investment decisions. Conversely, for day trading, go for scanners that excel in real-time data deliverance, like the intraday, technical, or pre-market scanners.

2. User Interface: The scanner's user interface should be easy to navigate, even for a novice. A complex interface can be a value-diminishing factor, as you'd spend more time figuring out operations rather than analyzing stocks.

3. Customizability: The best stock scanner is one that meshes well with your unique trading strategies. Hence, the scanner should allow customization with ease, aligning the filters as per your criteria.

4. Real-time Data and Subscription Models: Timely data is crucial. Some scanners may offer real-time data feeds, typically in exchange for a subscription fee, which is worth considering. Be aware of the budget and choose accordingly.

5. Customer Support: Robust and responsive customer support can assist in troubleshooting and enrich the user experience.

6. Trial and Error: Several platforms offer trial versions of their scanners. Utilize this service to understand if a particular scanner caters to your needs optimally.

By carefully considering these factors, you can hand-pick a stock scanner that fits perfectly with your trading endeavours, thereby streamlining your path to successful trading.

What are the Pros and Cons of Utilizing Stock Scanners?

When evaluating the merits and demerits of utilizing stock scanners, it’s essential to assess their functionality, cost-effectiveness, and relative ease of use against their limitations.

Key Advantages of Using Stock Scanners:

1. Time-saving: Manuel tracking every stock in the market is not feasible. Stock scanners drastically reduce this workload by providing only relevant information.

2. Real-time Data: Stock scanners provide up-to-date market information, allowing traders to capitalize on market trends instantly.

3. Customizability: Stock scanners can be adjusted to align with individual trading strategies, catering to varying trading needs.

Key Limitations of Using Stock Scanners:

1. Cost: Access to live data often comes at a premium, with most scanners requiring paid subscriptions for comprehensive services.

2. Data Overload: The vast amount of data provided can be overwhelming, especially for novice traders.

3. Dependence on Parameters: The effectiveness of a stock scanner hinges on the accuracy of the pre-set parameters. Inaccurate parameters could result in missed opportunities.

4. Limited Information: Some scanners may not provide all the needed data, necessitating the utilization of multiple scanners.

Conclusion

Stock scanners offer a powerful and efficient way to navigate the complex world of stock trading. Despite their downsides, their benefits make them an essential tool for modern traders, whether a newbie or veteran. By identifying the right scanner for your trading strategy, you can enhance your trading performance and make smarter, knowledgeable decisions.

Related FAQs about what are stock scanners

Can Stock Scanners predict future market directions?

Stock scanners do not predict future market directions; rather, they analyze current market conditions based on specified parameters. While they provide crucial insights to aid decision-making, they cannot guarantee what will happen in the future, as the stock market is influenced by a range of unpredictable factors.

Are Stock Scanners suitable for beginner traders?

Yes, stock scanners are suitable for beginners, albeit there is a learning curve involved. They simplify the task of identifying trading opportunities by analyzing market data. Beginners can start with user-friendly, customizable scanners that align with their trading strategies and gradually evolve their usage with experience.

What are some low-cost or free Stock Scanners that you recommend for stock trading beginners?

Yahoo Finance and Google Finance offer free stock scanners which are beginner-friendly. For more advanced features, Finviz offers a comprehensive scanner with both free and reasonably-priced premium options. TradingView also provides an interactive, feature-rich scanner with a tiered pricing structure suitable for different experience levels.